views

Five critical enablers to help you weather the storm

DUBAI, United Arab Emirates--(BUSINESS WIRE/AETOSWire)-- Recently, many countries have experienced massive global disruptions in supply chain due to an uptick in global demand, increases to shipping costs (+300% YoY) and commodity prices (+33% YoY), increases to energy costs (+20% YoY) due to low supply from gas and petrol and other renewable sources and even weather pattern disruptions. In an unprecedented competitive environment, the FMCG industry is facing inevitable price increases and is urged to take actions and reevaluate pricing strategies.

The way manufacturers can successfully navigate these turbulent times together with retailer partners in order to survive and thrive in the future, was the relevant topic of a recent NielsenIQ webinar with the title “How to land price increases during turbulent times”, directed at clients and partners in Europe, Middle East and Africa.

Leading companies understand the importance of profit contribution on proactive pricing strategy management. There are five key steps to leverage a pricing strategy, as recognized by NielsenIQ experts:

- Constantly scout for pricing opportunities

- Set a shopper-centric pricing strategy informed by granular shopper response models

- Anticipate competitive pricing actions and responses

- Activate a net price appreciation plan with full view of retailer P&L economics

- Support value creation story with innovation plans that create headroom for growth

According to Didem Sekerel-Erdogan, NielsenIQ Analytics Leader for Middle East and Africa: “Now more than ever, retailers and manufacturers need to help consumers manage their overall basket-spend by allowing them to flex their budgets. We want to help our clients to apply sustainable price strategies, monitor opportunities and provide insights to formulate the best gross to net price structure to maintain profitability”.

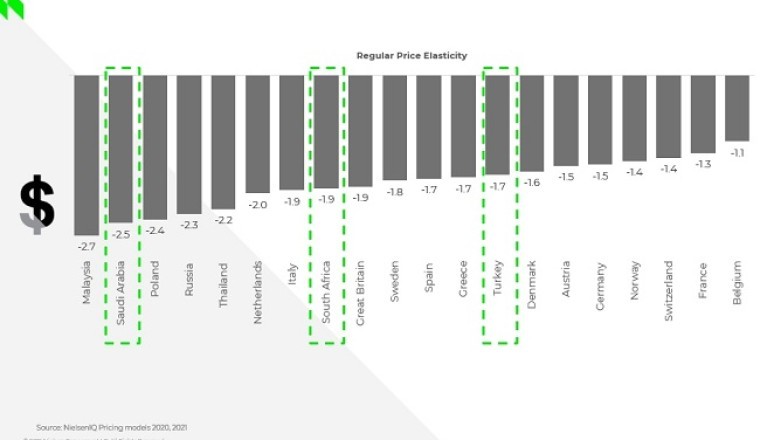

With price increases across Europe, Middle East and Africa, consumers are constantly changing their purchase and consumption behavior, adapting to turbulent times. At the same time, NielsenIQ experts are working hard to identify patterns across regions. For example, we see that in several markets Regular Price Elasticities are in the mid-to-high range:

Variations in elasticities across categories also apply on promo prices. Consumers have been making strategic shifts to consciously managing their budget both online and offline. Sekerel-Erdogan explains that: “While promotions remain key to drive sales, it is important to remember that you cannot simply apply the same strategy to every category. It is important to keep in mind that market dynamics may differ between categories, segments and brands, and that all is dependent on the target consumer and how they were affected by the pandemic”.

At the same time, it is evident that consumers are making strategic changes when it comes to spending and are getting savvier with their purchase decisions, by opting for private label products. As prices take on new heights, Private Label (PL) could become a more viable alternative, especially where PL price tiered options are available. Private labels have become the new strategy to diminish grocery costs and they continue to catch-up on brand share – 46% of shoppers opt for PL where possible (Source: NielsenIQ RMS KSA, UAE).

To summarize, consumer price sensitivity is on the up, while price elasticities shift depending on category and need. Consumers seem to be very savvy about spending, have changed their shopping habits and traded down in categories. Quality safety and health remain key attributes.

Comments

0 comment