views

Dubai-based fintech innovator showcases cutting-edge innovations in customer retention and loyalty.

Fintech Surge 2024, the Middle East’s leading event for financial technology, is buzzing with new innovations aimed at transforming customer engagement and loyalty. Among the standout companies showcasing at this year's event is TOTL, a pioneering Dubai-based fintech firm, set to make a significant impact by unveiling its latest solutions, including a powerful mobile app and dynamic QR code technology.

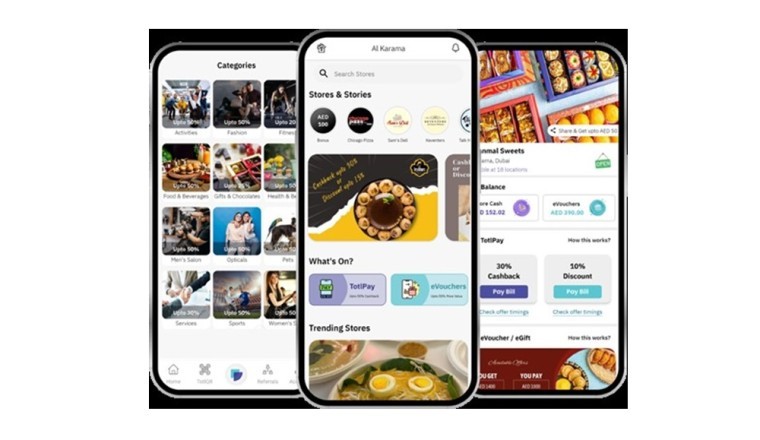

TOTL is redefining how businesses enhance customer retention and loyalty with solutions designed to drive engagement, boost brand loyalty, and elevate customer experiences. Focused on delivering seamless, value-driven payment experiences, the platform empowers businesses in the UAE to organically build long-term loyalty through instant rewards and frictionless transactions.

At the core of TOTL’s offering is its QR Code Technology, which integrates various digital tools to create an all-in-one solution for businesses and consumers. Through TOTL’s dynamic concept, which entails app and QR code abilities, companies can connect directly with customers by offering cashback, eVouchers, and eGifts—all in real time. This has resulted in impressive user growth, with a 200% increase over the past year and a 100% rise in new business partnerships.

A Fintech Solution for the Future of Loyalty

As businesses across the UAE compete in a fast-evolving market, TOTL’s mobile app stands out for its ability to deliver instant rewards and personalised offers that drive customer retention. Built with user experience at its core, the app simplifies transactions and provides businesses with valuable insights into customer behaviours, helping them foster stronger relationships and enhance brand loyalty.

TOTL’s dynamic QR technology extends the app, enabling businesses to offer personalised, repeatable payment experiences. However, the app’s innovation goes beyond QR code payments, turning purchases into engaging experiences that keep customers coming back without app dependency.

"At TOTL, we see our mobile app as more than just a payment platform; it’s a loyalty ecosystem," said Uday Rathod, CEO and Co-Founder of TOTL. "The success of our QR technology for Payments is just one aspect of how we're helping businesses build lasting relationships with their customers , not just with rewarding payment experiences but by its dynamic approach , creating a realm of brand engagement opportunities which is equally gratifying."

Leveraging Digital Tools for Business Growth

TOTL’s concept empowers businesses to stay competitive by offering simple yet powerful channels to engage and retain customers. Through instant cashback rewards, eVouchers, and personalised offers, TOTL delivers immediate value on every transaction, fostering trust and loyalty between customers and businesses. With payment growth surging by 500%, TOTL is clearly shaping the future of customer retention through its innovative digital approach.

"We’re committed to giving businesses the tools they need to thrive," said Sulochana Betwala, COO and Co-Founder of TOTL. "TOTL's concept goes beyond payment transactions, creating long-lasting customer engagements. Businesses are retaining more customers and experiencing significant growth through increased interaction with TOTL’s loyalty-driven features."

TOTL at Fintech Surge 2024

Attendees of Fintech Surge 2024 will have the opportunity to experience the power of TOTL’s offerings firsthand at the booth (H10-A2). TOTL will offer live demonstrations of how it helps businesses transform everyday transactions into meaningful customer relationships through various features, including instant cashback and Dynamic QR codes.

With its innovative solutions, TOTL continues to lead fintech, helping businesses across the UAE leverage the digital mechanism to enhance customer retention and engagement in an increasingly competitive landscape.

Comments

0 comment