Dubai, United Arab Emirates, 21 June 2020, (AETOSWire): Warner Music Recording Studio was set to list on stock markets last Wednesday and has represented the largest IPO of the year. Despite that, some companies are delaying their listings due to COVID-19 pandemic, the company has increased the volume of its offered shares from $70 million to $77 million.

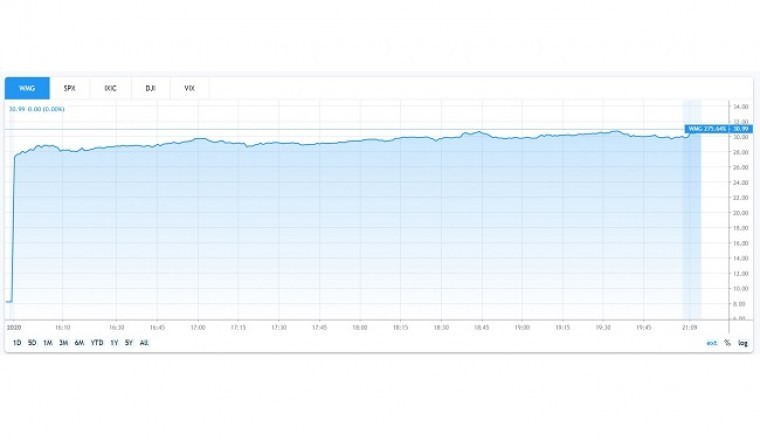

Issue price was $25 per share, yet the company started its trading on the Nasdaq Stock Market with the price of $27 per share. The stock price has grown over $30 in the end of its first trading day, which represents almost 20.5% price growth.

Warner Music received a total of $1.9 billion during its IPO. Moreover, market capitalization of the company increased to $12.75 billion. The growth has exceeded analysts' forecasts, who expected the company’s value to roughly reach $6 billion.

The company has been listed on New York Stock Exchange until 2011, when it was purchased for roughly $3.3 billion by Access Industries, a company belonging to a billionaire Leonard Blavatnik. Access Industries has been a majority owner since. Based on information provided by Tradingview.com, back then the share value was roughly $8 per share.

The New York based company has, similarly to other recording companies, made a progress and its position has significantly improved especially due to development of subscription music streaming services such as Spotify, Deezer, Tidal, Google Play Music or Apple Music. Recording companies managed to compensate the loss caused by music piracy and stabilized its market position.

Warner Music is currently world’s third largest recording company based on the market share and cooperates with celebrities such as Madonna, Ed Sheeran and James Taylor. The two larger studios are Universal Music Group and Sony Music Entertainment.

During last fiscal year, finished in September 2019, the company reported yields of $4.48 billion and profit of $258 billion.

Facebook Conversations

Disqus Conversations